15-Year Fixed Mortgage Rates

A 15-year mortgage can help you pay off your home sooner and save on interest costs. But higher payments and other drawbacks are worth considering too.

A 15-year mortgage usually comes with a lower interest rate but higher monthly mortgage payment. (Shutterstock)

You may not hear about them often, but 15-year mortgage loans are actually quite popular — particularly in times when current mortgage rates are low. In fact, about 15% of all mortgage loans come with a 15-year term, according to the Urban Institute, a nonprofit research organization.

A 15-year loan term is popular for multiple reasons, including quicker payoff timelines, lower interest rates, and fewer costs in the long run. But 15-year loans can have disadvantages too.

If you’re considering a 15-year mortgage, Credible makes it easy to see your prequalified mortgage rates in minutes.

- Today’s 15-year mortgage rate trends

- Historical mortgage rates

- How Credible mortgage rates are calculated

- Pros of a 15-year mortgage

- Cons of a 15-year mortgage

- Find the right mortgage for you

- How to get a good 15-year fixed rate

- What credit score do you need to get a good 15-year mortgage rate?

- Should you get a fixed-rate mortgage or a variable-rate mortgage?

Today’s 15-year mortgage rate trends

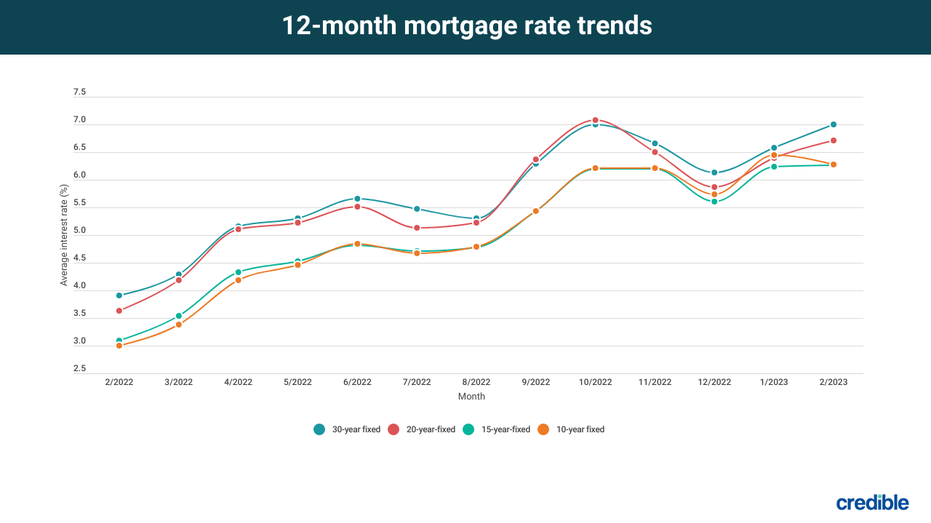

Here’s how mortgage refinance rates have been trending over the past 12 months.

Historical mortgage rates

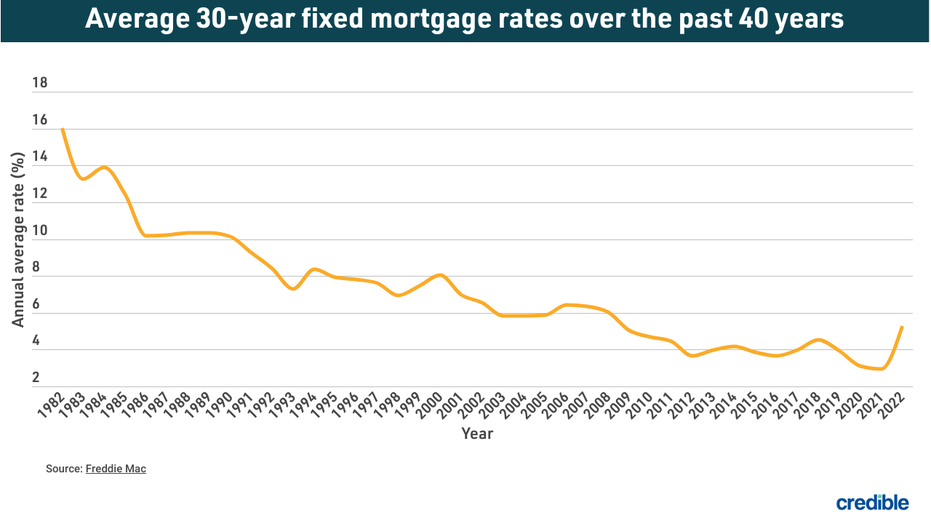

Here’s what the annual average mortgage interest rate has looked like for the past 39 years.

How Credible mortgage rates are calculated

Changing economic conditions, central bank policy decisions, investor sentiment, and other factors influence the movement of mortgage rates. Credible average mortgage rates and mortgage refinance rates are calculated based on information provided by partner lenders who pay compensation to Credible.

The rates assume a borrower has a 740 credit score and is borrowing a conventional loan for a single-family home that will be their primary residence. The rates also assume no (or very low) discount points and a down payment of 15%.

Credible mortgage rates will only give you an idea of current average rates. The rate you receive can vary based on a number of factors.

Credible makes it easy to compare rates from multiple lenders in just minutes.

Pros of a 15-year mortgage

A 15-year mortgage offers multiple benefits, including:

- Typically have much lower interest rates, saving you money over the life of the loan

- Build home equity faster as you pay a larger percentage of the principal sooner

- Pay off your mortgage sooner

Cons of a 15-year mortgage

But 15-year mortgages also have some disadvantages that offset the advantages, including:

- Higher monthly payments because the loan spreads the repayment period over fewer months

- Higher payments may reduce your homebuying power (you’ll need to buy a cheaper house to stay on budget)

- Higher monthly mortgage payments may make it difficult to meet other financial goals, like saving or investing

Find the right mortgage for you

Before taking out a 15-year mortgage for a home purchase, you should pull your credit report and check your credit score. Higher scores mean lower rates, so if yours is below 740, you might consider taking some time to improve it before applying for a loan.

You’ll also want to use a mortgage calculator to compare a 30-year loan versus a 15-year one. This can help you understand how both options would impact your homebuying budget, as well as your monthly and long-term costs.

Finally, you should shop around with at least three to five lenders. Once you apply for approval, they’ll give you a loan estimate, which you can then use to compare each offer's APR, closing costs, fees, terms, and other details line by line.

How to get a good 15-year fixed rate

Mortgage lenders typically look at three main factors when determining your interest rate: down payment, credit score, and debt-to-income (DTI) ratio. Improving any of these areas can help reduce your interest rate, as well as your chances of qualifying for the loan.

This might look like:

- Increasing your down payment

- Improving your credit score

- Paying down debts

- Increasing your income with a side gig or extra hours

You should also pull your credit report and alert the credit bureau of any errors you find. Once remedied, it could improve your score.

What credit score do you need to get a good 15-year mortgage rate?

The credit score you’ll need to qualify for a mortgage can vary depending on the lender and type of mortgage. For example, you may be able to qualify for an FHA loan with a credit score of 500 if you also have a down payment of at least 10%. And VA loans and USDA loans typically have no minimum credit score requirements.

For conventional loans, however, lenders typically reserve their lowest interest rates for borrowers with the highest credit scores — those in the "very good" or "exceptional" categories.

Here’s a full breakdown of score ranges, according to FICO:

- 580 or lower: Poor

- 580 to 669: Fair

- 670 to 739:Good

- 740 to 799: Very good

- 800 or higher: Exceptional

Is a 15-year fixed mortgage a good deal?

A 15-year fixed-rate mortgage can be a good move if you want to minimize your interest costs or pay off your loan in a shorter amount of time. But if you’re focused on achieving lower monthly mortgage payments or you want a larger homebuying budget, it may not be the best fit.

If you’re still not sure which is right, consider talking to a mortgage broker or loan officer. They can draw up quotes for both 15- and 30-year mortgage loans to see which matches your goals best.

Checking your prequalified rates on Credible doesn’t affect your credit score.

Should you get a fixed-rate mortgage or a variable-rate mortgage?

Fixed-rate loans are the most common type of mortgage, and they come with a consistent interest rate and payment for the life of your loan term. Another option, though, is the variable-rate mortgage, which has an interest rate that fluctuates over time.

While adjustable-rate mortgages, or ARMs, typically come with lower interest rates upfront, those rates can increase over time (and send your monthly payments upward as well).

These loans are typically best if you know you’ll only be in the home a short amount of time, you expect to make higher income before your rate can increase, or you’re confident you can refinance at that point. Again, talk to a mortgage pro if you’re unsure of which loan product is best. They can look at your credit, budget, and long-term goals and help you determine the most fitting mortgage for your financial situation.