30-Year Fixed Mortgage Rates

Because 30-year mortgages spread payments over a longer term, the monthly payments are lower — which can leave you with more room in your budget.

Not sure if a 30-year mortgage is right for you? Keep reading to learn more about 30-year mortgage rates and this loan term’s pros and cons. (Shutterstock)

Thirty-year mortgages are easily the most popular home loan option: Almost 90% of buyers opt for a 30-year mortgage, according to Freddie Mac. This long loan term can make your monthly payments much more manageable, which can take some strain off your budget and free up money each month to add to your savings or put toward other financial goals.

The downside is that 30-year mortgages tend to have higher interest rates, since your payments are spread out over such a long period. And because of the higher rates and more years of paying them, you’ll end up paying more in total interest over the life of a 30-year mortgage.

If you’re thinking about a 30-year mortgage, Credible lets you easily compare your prequalified mortgage rates in minutes.

- Today's 30-year mortgage rate trends

- Historical 30-year mortgage rates

- How Credible mortgage rates are calculated

- Pros of a 30-year mortgage

- Cons of a 30-year mortgage

- Find the right mortgage for you

- How to get a good 30-year fixed rate

- What credit score do you need to get a good 30-year mortgage rate?

- Should you get a fixed-rate mortgage or a variable-rate mortgage?

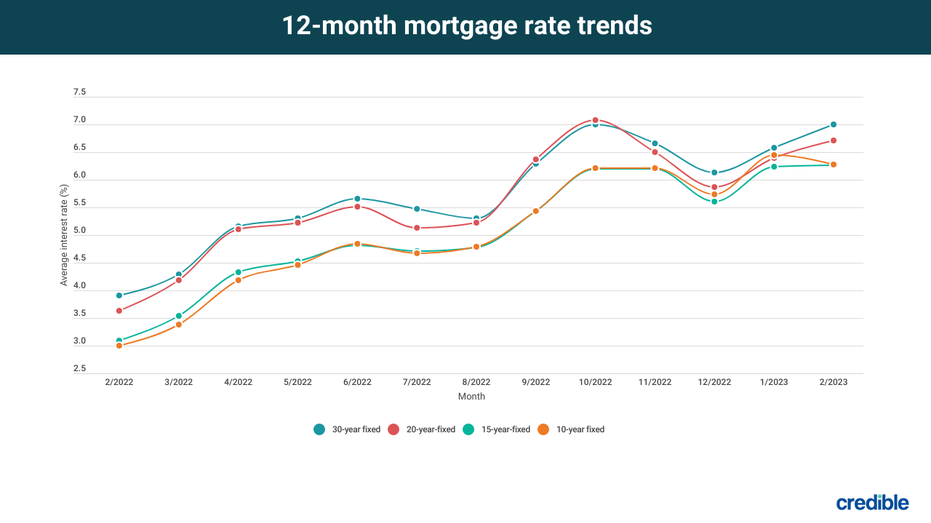

Today’s 30-year mortgage rate trends

Here’s how mortgage rates have been trending over the past 12 months.

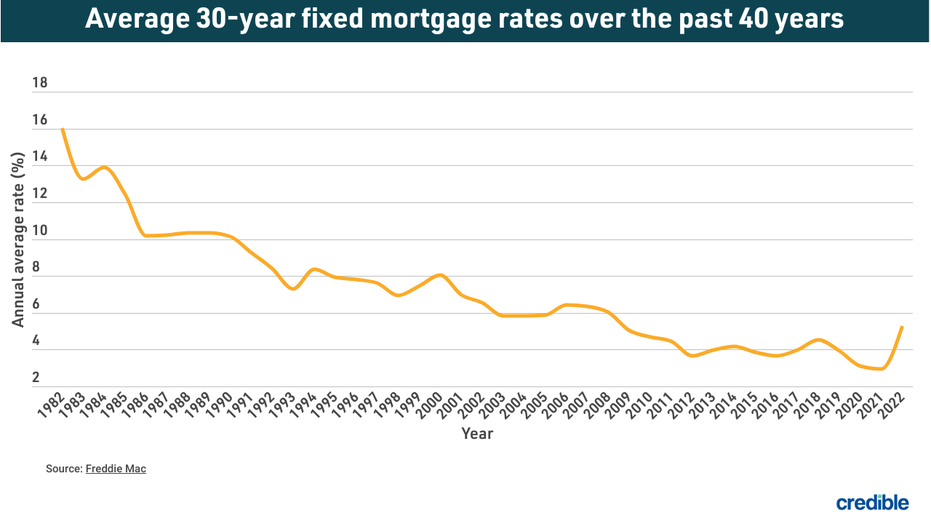

Historical 30-year mortgage rates

Here’s what the average annual 30-year mortgage interest rate has looked like for the past 39 years.

How Credible mortgage rates are calculated

Changing economic conditions, central bank policy decisions, investor sentiment, and other factors influence the movement of mortgage rates. Credible average mortgage rates and mortgage refinance rates are calculated based on information provided by partner lenders who pay compensation to Credible.

The rates assume a borrower has a 740 credit score and is borrowing a conventional loan for a single-family home that will be their primary residence. The rates also assume no (or very low) discount points and a down payment of 20%.

Credible mortgage rates will only give you an idea of current average rates. The rate you receive can vary based on a number of factors.

Credible makes it easy to compare mortgage rates, without affecting your credit score.

Pros of a 30-year mortgage

A 30-year mortgage offers certain advantages, including:

- Lower monthly payments — Because a 30-year mortgage loan spreads payments out over three decades (instead of a shorter loan period, like 15 years), you can expect lower monthly payments.

- Frees up money each month — With lower monthly payments, you’ll have more money on hand to grow your savings, pay off other debts, or potentially invest.

- More flexibility — Taking out a 30-year mortgage gives you the opportunity to treat your mortgage like a 15-year one by making extra payments, which allows you to pay off your mortgage early. You can also stick with the minimum monthly payment when your budget is feeling tighter.

Cons of a 30-year mortgage

It’s also important to consider the disadvantages of a 30-year mortgage, including:

- Higher interest rate — Longer loan terms typically come with higher interest rates in exchange for those lower monthly payments.

- Higher overall cost — Since you’ll likely face a higher interest rate with a 30-year loan, you’ll pay more interest over the life of the loan, which will increase your loan cost.

- Longer commitment — If your main goal is to be debt-free, you may prefer to pick a shorter term and pay off your home loan quicker. With a 30-year mortgage, you’re saddled with a house payment for much longer.

Find the right mortgage for you

If you’re ready to take out a mortgage, follow these steps to find the best fit for you:

- Budget accordingly. Before you start shopping around for a mortgage, make sure you understand what you’re getting into financially. In addition to figuring out how much you can afford to pay for a mortgage and other homeownership costs on a monthly basis, it’s a good idea to calculate how much you expect to spend on your down payment, closing costs, and any fees associated with your mortgage loan so you don’t end up with an expensive surprise.

- Review your credit report. Mortgage lenders take your credit score and overall credit history into account when deciding what interest rate and terms to offer you. Before you apply for a mortgage, review your credit score and report at AnnualCreditReport.com. Check for any errors that you need to dispute and see if there’s anything you can do to improve your credit.

- Shop for the best rates. It’s a good idea to comparison shop to find the best mortgage lender for you. This way you can find out which one will offer you the best rates and terms.

- Get pre-approved for a mortgage. Getting pre-approved for a mortgage loan will give you a pretty good idea of how much money a mortgage lender will be willing to lend you once you officially apply for a mortgage. This will be really helpful when it comes time to make an offer on a home.

How to get a good 30-year fixed rate

If you decide that a 30-year fixed-rate loan is a good fit for you, you’ll want to do what you can to impress lenders. The main factors lenders look at are:

- Down payment — Lenders appreciate seeing a higher down payment amount since that means you’ll borrow less money. They consider it a good sign that you won’t default on your mortgage payments.

- Credit score — All mortgage lenders take credit scores into account, as your credit score indicates how reliable you are when it comes to repaying your debts. Lenders offer lower interest rates to borrowers with good credit scores.

- Debt-to-income (DTI) ratio — On top of your credit score, mortgage lenders also look at your DTI ratio to see how much debt you already have in comparison to your income. The lower this ratio is, the better.

What credit score do you need to get a good 30-year mortgage rate?

Mortgage lenders issue home loans to borrowers with a variety of credit scores (including bad ones), but the higher your credit score is, the more likely you’ll be able to qualify for better rates. To secure the lowest interest rates, you’ll want to have an exceptional or very good credit score.

This is how FICO rates different scores:

- 300 to 579 — Poor

- 580 to 669 — Fair

- 670 to 739 — Good

- 740 to 799 — Very good

- 800 to 850 — Exceptional

Lenders typically look for a credit score of at least 620 for conventional mortgages. But USDA loans and VA loans have no credit score requirements.

Is a 30-year fixed mortgage a good deal?

If you’re looking to keep your monthly payments manageable, a 30-year mortgage may be the best option for you. Because 30-year mortgages spread payments out more, the monthly payments are lower than shorter-term loans, which can leave you with more room in your budget each month.

But if you want to save as much as possible on interest or be debt-free faster, a shorter loan term, like 10 or 15 years, may be better for you — as long as you can afford a higher monthly payment.

If you’re ready to purchase a home, use Credible to compare mortgage rates from multiple lenders, all in one place.

Should you get a fixed-rate mortgage or a variable-rate mortgage?

Fixed-rate mortgages come with a set interest rate that won’t change throughout the life of the loan (which makes them easier to budget for). Variable- or adjustable-rate mortgages (ARMs) have interest rates that can change while you pay off your mortgage.

With an ARM, you’ll pay a fixed interest rate for a set amount of time — which is generally lower than rates for a fixed-rate mortgage. But once that period ends, your interest rate will fluctuate based on market conditions.

If you plan to live in your home a long time, a fixed-rate mortgage may be better for you. But if you don’t think you'll live in the home for very long, an adjustable-rate mortgage may be a good option. Also consider your monthly payment preferences — if you’d rather have a steady monthly mortgage payment, opt for a mortgage with a fixed interest rate.